Is a poor credit score holding you back in life? Your credit score can greatly impact your ability to borrow money and affects interest rates on loans, credit or finance. If you’ve found yourself with a low credit score, you may be wondering how to increase it and the steps you need to take to get there. Follow our top tips on how to improve your credit score.

What is a credit score?

A credit score is a number that represents how well you can pay back money and manage your financial life. Your credit score is provided by a credit reference agency and based on your past history of borrowing, represents how likely you are to pay back future loans, credit or finance. In short, if you handle your finances correctly, pay on time and have low levels of debt, you’ll probably have good credit. If you miss payments, heavily rely on credit or have no credit history, you may find yourself with a low credit score. Your credit score is calculated by a number of factors and takes into account things like how much of your available credit you’re using, your total amount of debt, your repayment history and the number of credit searches on your report.

Why do you want a good credit score?

There are several reasons why having a good credit score is better for your financial life. You may find it easier to get approved for loans and finance as you are seen as less of a risk. Lenders may use a credit check before deciding whether they want to offer you a loan or not. If you have a long history of handling your credit correctly and making all payments on time and in full, you’ll be less likely to default on any loans in the future too. This can give you access to the best and lowest interest rates, higher credit limits on credit cards and gives you more negotiation power. Paying lower rates of interest can literally save you thousands of pounds when compared to someone with a poor credit score. When it comes to car finance, your credit score can affect the loan you are offered.

Is it easy to improve your credit?

It can be possible for anyone to improve their credit situation. However, it does take time and effort. Rebuilding a bad credit score is all about creating new financial habits, reducing debt, and working to show future lenders you can handle your credit efficiently. If you’re experiencing major financial issues such as bankruptcy, defaults on your credit reports, County Court Judgements or have entered into an IVA, it can take years to rebuild a poor credit score. But, the financial rewards once you do can speak for themselves.

1. Check your credit report.

The first healthy credit habit to get into is checking your credit score every month. By checking your credit report, you can get an insight into the factors which are holding you back, see the information listed about you, how much debt you currently owe, and your repayment history. Misinformation on your credit report can negatively impact your credit score, so make sure all your information is correct and up to date. You should also keep an eye on your applications for credit and check they were made by you. Credit fraud is a big problem in the finance industry and can impact your credit file.

How to check your credit score.

2. Pay your bills on time.

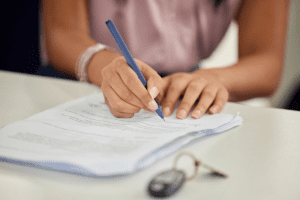

If you already have credit agreements in place, you must meet all the repayments on time and in full. Most credit companies will ask you to set up a direct debit to ensure the payment is taken each month and help you manage your money effectively. Make sure you have enough money in your bank account before the payment is taken. If you’re struggling to meet the repayment schedule of a loan, the worst thing you can do is stop making the repayments. Instead, speak with the finance lender to see how they could help and make them aware of your current situation.

3. Pay down your debt.

Before you think about taking on more finance or credit, you should first assess how much credit you currently have and what debt you owe. Try to pay down things like credit cards, store cards or credit accounts before you apply for new credit. Not only will it free up some money, but it will also better your credit score. If you want to reduce your car finance or mortgage payments, you could ask your lender about making overpayments to help settle the finance sooner.

4. Have a good mix of credit.

There are many different types of credit you can obtain, including mortgages, credit cards, car finance, personal loans, store cards, mobile phone contracts, overdrafts and more. A good mix of credit can help boost your credit score as it shows lenders you can be trusted to handle different types of finance. Having a diverse range of credit accounts allows you to experience different credit and learn how to utilise them.

5. Use credit little and often.

The credit utilisation ratio is the percentage of credit you’re using to how much credit you have available. It is recommended you only use around 50% of your available credit limit at once and under 30% if you really want to boost your credit score. For example, if you have a credit card with a limit of £1000, you should only spend around £300 at once. Then, either pay it off in full by the due date or make more than the minimum payment each month towards paying it off. Having credit isn’t a bad thing but being reliant on credit is.

6. Keep old credit accounts open.

For a long time, it was seen as good practice to close old credit accounts. However, credit referencing agencies have started to take notice of the accounts you have and the age of them. Even if you don’t use an old bank account or spend any money on a credit card, you should still keep these accounts open. Long-standing, unused accounts can help to improve your credit because it is evidence you’ve been using credit correctly for years.

7. Register on the electoral roll.

The electoral roll is a UK list which holds all the names and addresses of people who are eligible to vote. But, what has it got to do with your credit score? Well, your electoral information is recorded on your credit file. It helps to prove where you live, verify your identity and help to better your credit score. When you’re already on the electoral roll, it can help speed up the finance process because lenders can quickly verify your information. If you’re not yet registered on the electoral roll, you can do it now.

8. Build a credit history.

Did you know having no credit can give you bad credit? Credit scores are all about future predictions, and if you’ve never borrowed before, lenders have no information to go on. Start your credit-building journey by borrowing small amounts and paying them back on time. Use something manageable like a mobile phone contract in your name and set up a direct debit to collect the monthly payment. You could also consider a credit-building credit card and make small purchases each month. Make sure you pay off the balance in full by the due date and your credit score can flourish.

Recommended articles for you.

Who is the best credit reference agency to use?

In the UK, there are 3 credit referencing agencies that we recommend using when checking your credit score. Find out which is best.

What do the codes on your credit report mean?

The codes on your credit report may look like AA, DF, OK or DM, but what do they mean?

What are the most common car finance mistakes?

Not checking your credit report before car finance is one of the biggest car finance mistakes drivers make. Find out what else makes the list.